Unwinding Speculation In Metals, Crypto, And Growth Stocks

Feb 9, 2026

•

Lawrence Fuller

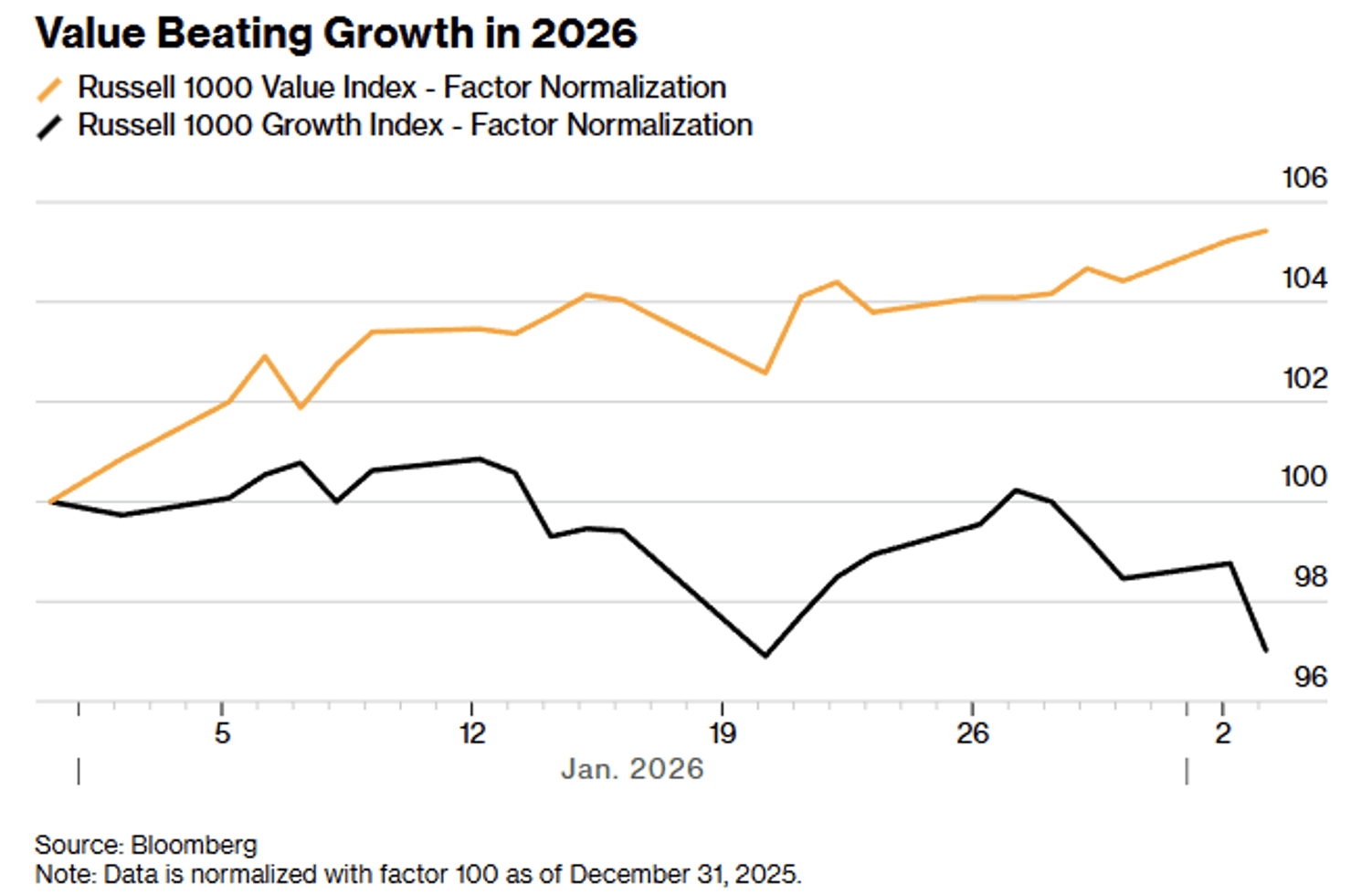

Value Is Outperforming Growth

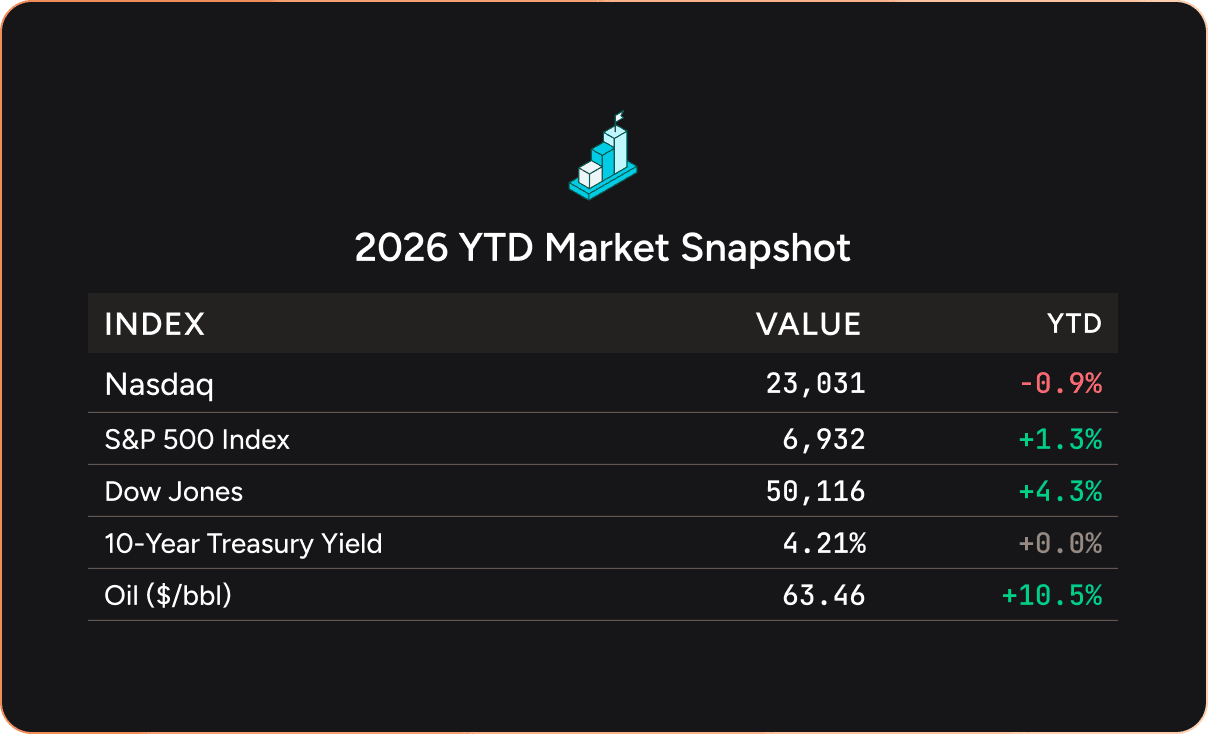

Last week, in a crushing blow to the most speculative corners of the market, the S&P500 surrendered all of its gains for the year leading to an oversold bounce on Friday. The targets were precious metals, cryptocurrencies, and expensive growth stocks. While those who are more pessimistic assert this sell off to be the bursting of an AI bubble that could be the end of the bull market, I see it as a healthy correction in concert with a rotation from growth to value that is leading to new leadership beyond the technology sector. This isn’t the bottom of the ninth, but more like the seventh inning stretch. Money is rotating to more economically sensitive sectors (cyclical) like energy, industrials, transportation, and less expensive consumer staples. As I have noted for several months, the writing was on the wall for this rotation, as earnings growth for the technology sector started to decelerate during the second half of last year, while it was accelerating for the remaining sectors of the market from much lower levels.

Despite some signs of economic fragility, the expansion that underpins this bull market remains on track. My greatest concern is the stagnant labor market. According to ADP, the private sector added just 22,000 jobs last month, while employers announced 108,000 job cuts, which was the largest number for a January since 2009. Still, there are some encouraging developments that should help revive job creation.

The manufacturing sector is finally showing some signs of life with the Institute for Supply Management’s business activity index moving into expansion territory for the first time in a year. The Tax Foundation estimates that the average tax refund per household will be $750 more than last year, due to tax cuts from the One Big Beautiful Bill Act. This totals approximately $129 billion in additional spending power to be distributed over coming months. Corporations are now incentivized to increase capital spending with the ability to expense 100% of the cost of qualified property, which should boost investment beyond what is already in the pipeline for AI infrastructure. These tailwinds should support economic growth in 2026 and ultimately lead to an increase in job creation.

Consider The Cost Of Money

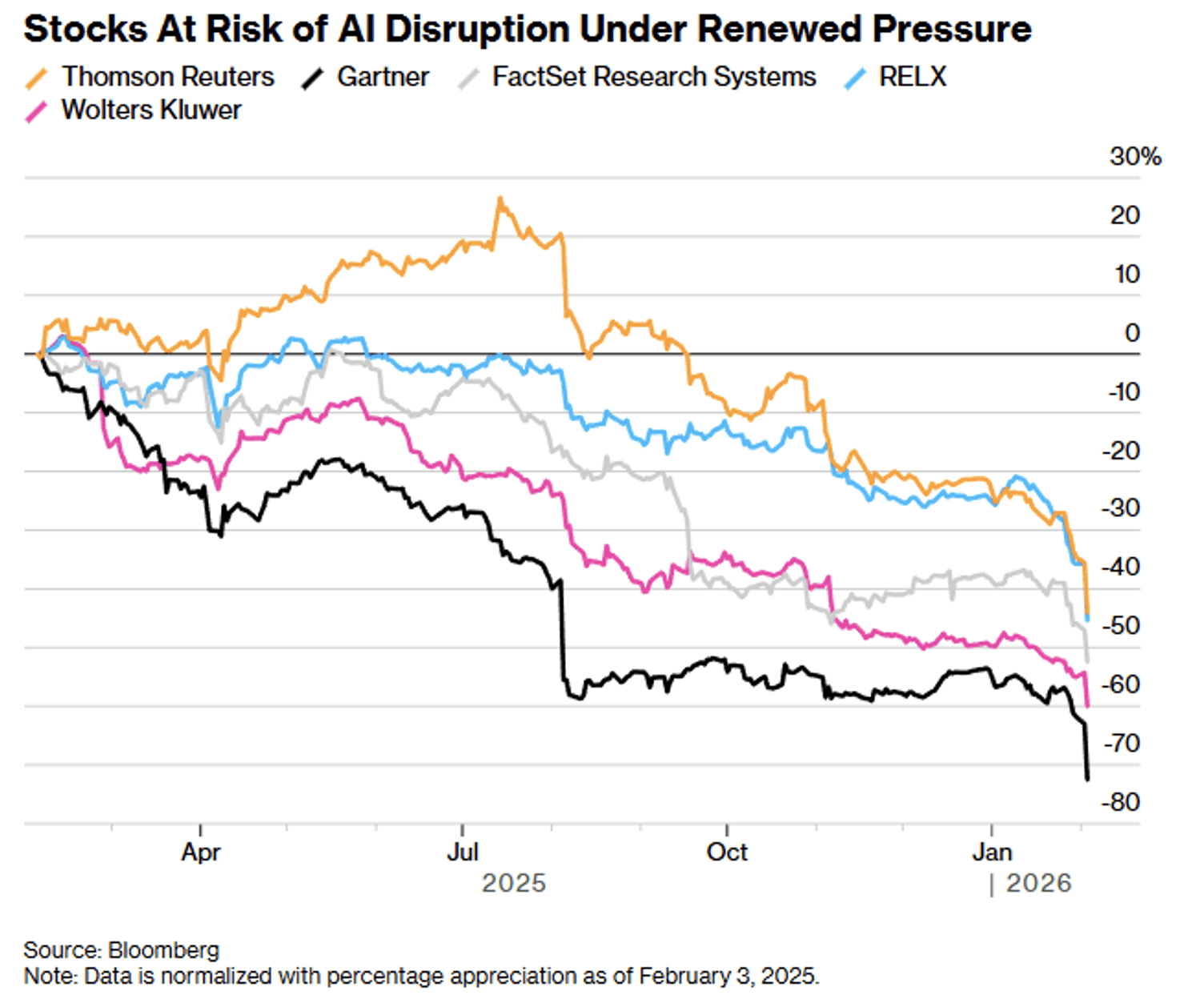

Valuations are horrible timing tools in terms of telling us when prices may fall, but they speak volumes about downside risk. A severe price decline needs a catalyst, and the most recent one was the introduction of new AI automation tools from Anthropic, which could undermine the business models of numerous companies. This sent stocks in the software sector reeling last week. Additionally, the ongoing shift from growth to value exacerbates these declines, because investors have alternatives for growth.

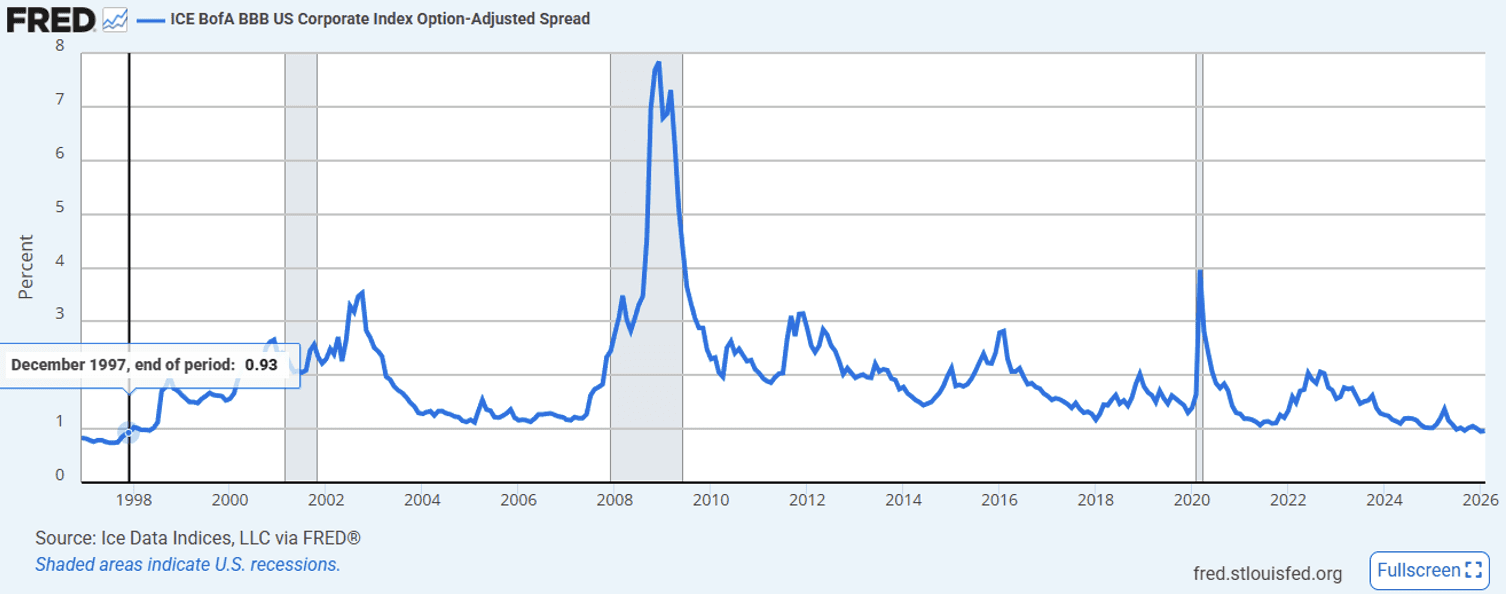

Another factor in valuations that investors need to consider is the cost of money, which is measured with credit spreads. The credit spread is the difference between what it costs the federal government to borrow money, based on Treasury yields, and the cost for a corporation to borrow over the same duration. Today, The BBB Corporate Index Spread at 96 basis points is the lowest it has been since December 1997. A bottom in spreads usually corresponds with a peak in valuations. When credit is this cheap, it inflates valuations for growth stocks, but that is a double-edged sword. Any increase on spreads, which have likely bottomed, leads to valuation compression for the fastest growing momentum stocks, especially those with no profits that trade at exorbitant multiples to revenue.

When Market Darlings Become Outcasts

The sell off in high-growth momentum stocks spread to other corners of the market where speculation had driven prices to unsustainable levels. I warned about the meteoric rise in silver two weeks ago, which was followed by a 40% collapse in its price last week. Bitcoin has fallen 43% from its all-time high, while Ether has collapsed 57%. This is largely because the same cohort of investors chasing momentum in stocks were using leverage to buy precious metals and cryptocurrencies. When prices abruptly drop, margin calls fuel a steeper decline. I think we are close to clearing out that leverage, which should provide some support, but investors should still be leery of investing in the most expensive growth stocks in anticipation of realizing last year’s returns.

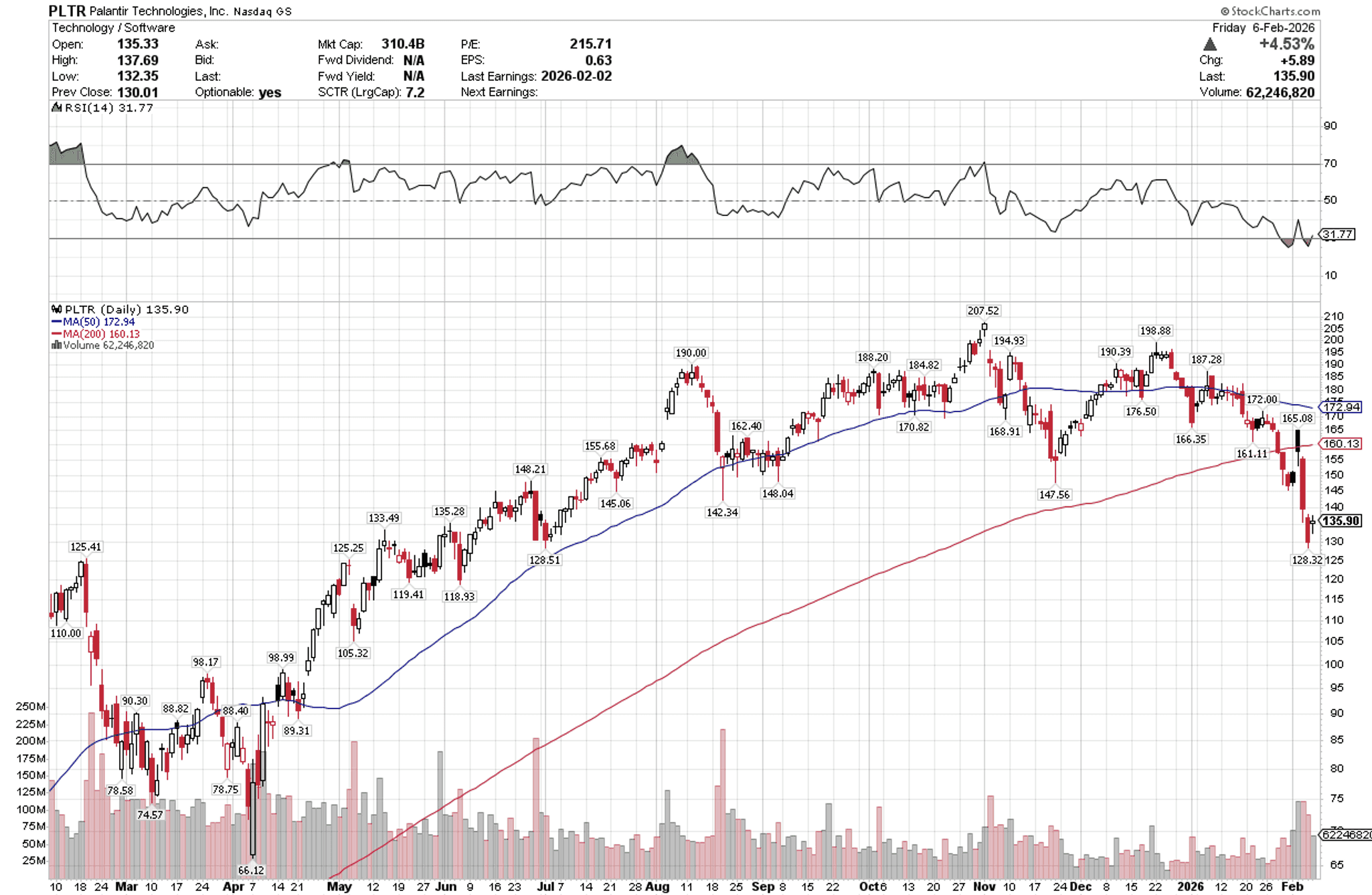

A case in points is a market darling in the technology sector. Palantir Technology (PLTR) reported stellar earnings results last week, and management forecasted that revenue for 2026 would be well above Wall Street’s expectations, leading to several upgrades. Yet the stock dropped 9% last week and is down 23% so far this year. This may be a phenomenal company, but its valuation is unsustainable in my view. The shares trade at more than 100 times earning and 50 times revenue. The stock could get cut in half, and it would still be expensive. We are seeing valuation compression in action, given the market dynamics going on today.

Now consider what happens to growth stocks that trade at similar multiples to revenue but have no earnings, which means they are more reliant on the credit market. This is where the market darlings of the past three years could become outcasts in 2026. Buyers beware.

Lawrence Fuller

Founder of Fuller Asset Management & dub Portfolio Creator SeekingAlpha Top Contributor (22k followers)

Background

With three decades of experience in portfolio management, Lawrence commenced his career at Merrill Lynch in 1993 and subsequently held similar roles at various Wall Street firms before establishing Fuller Asset Management in 2005. Since 2013, he has been an esteemed contributing writer for Seeking Akpha, authoring the widely followed Morning Brief newsletter, which boasts a dedicated readership exceeding 22,000 investors.

© 2026 DASTA Incorporated. All Rights Reserved. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. The dub app is owned and operated by DASTA Inc.. Advisory services provided by Dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. This content is provided for informational purposes only and is not intended as and may not be relied on in any manner as a recommendation or endorsement of any user, portfolio, thematic idea, or ESG factor offered by DASTA Incorporated (DBA “dub”) or its subsidiaries or affiliates (together “dub”). All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results, and investors should consider their own investment goals, risk tolerance, and financial situation before investing. The content herein is not warranted as to completeness or accuracy and is subject to change. The information presented, and its importance is an opinion only and should not be relied upon as the only important information available. The information may contain forward looking statements, including assumptions, estimates, projections, opinions, models and hypothetical performance analysis, which are inherently subjective. Changes thereto and/or consideration of different or additional factors could have a material impact on the statements made herein and Dub assumes no liability for the information provided. Advisory services provided by DASTA Investment, LLC (“Dub Advisors”), an SEC-registered investment adviser. Brokerage services provide by Dub Financial, LLC, and clearing and execution services by APEX Clearing Corporation (“Apex”), both SEC-registered broker-dealers and members of FINRA/SIPC. The registrations and memberships above in no way imply that the SEC, FINRA, or SIPC has endorsed the entities, products or services discussed herein. Additional Information is available upon request.