The Rotational Correction Continues, But Presents Opportunities

Feb 16, 2026

•

Lawrence Fuller

AI Disruptions Impact Various Sectors

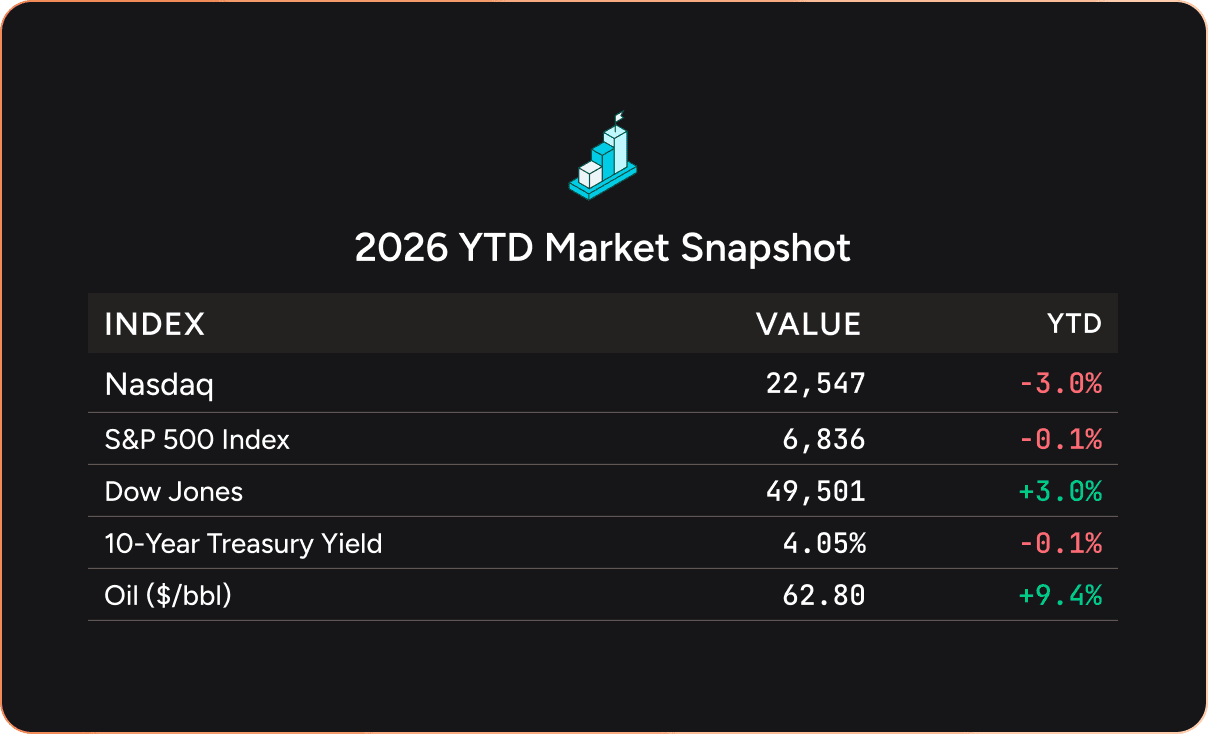

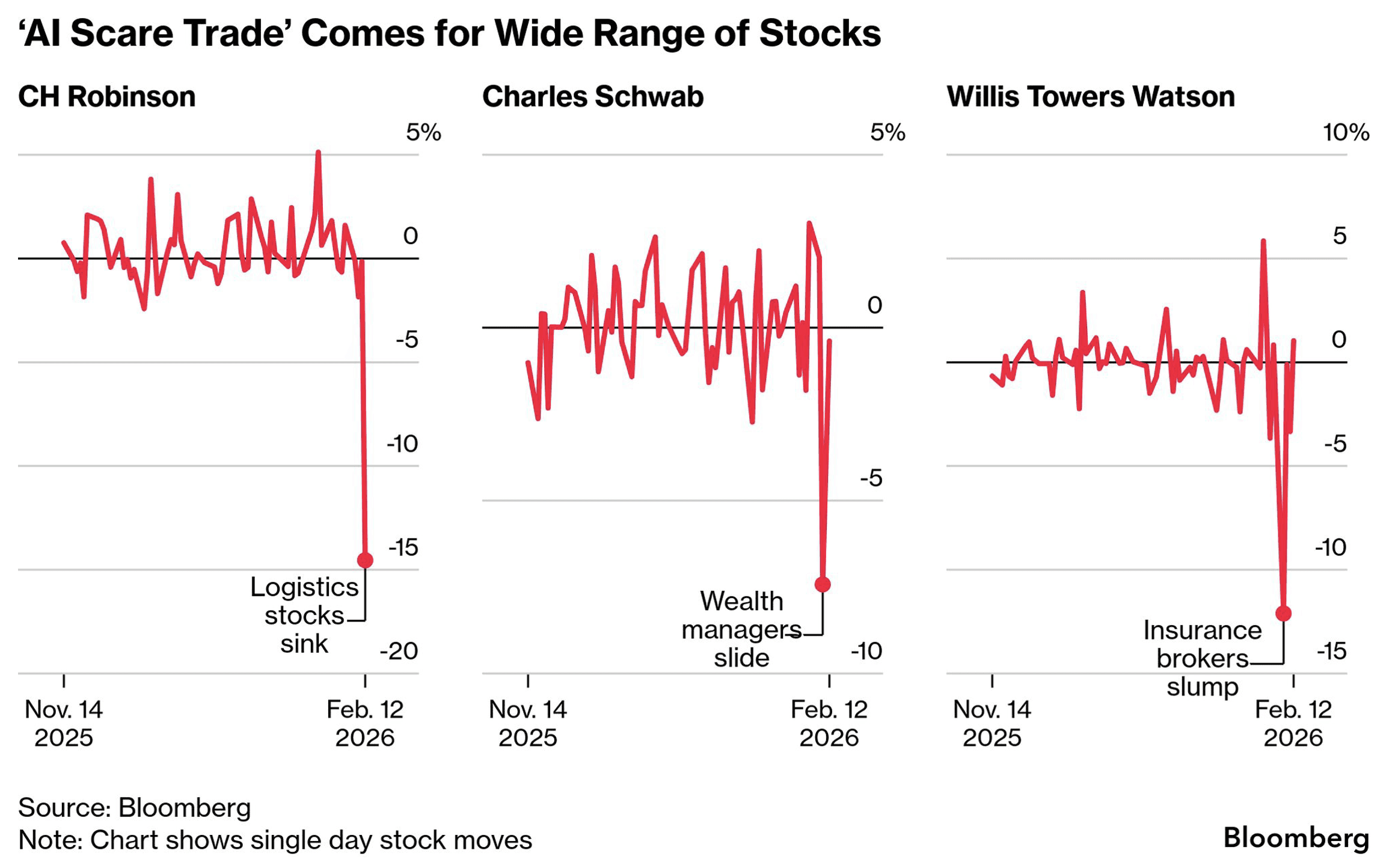

While the S&P 500 suffered its worst week since the pullback in November, the equally weighted version of the index continues to hover near all-time highs, as investors scale out of expensive growth stocks into other more cyclical and value oriented ones. This rotational correction is starting to impact companies outside of the technology sector whose business models are perceived to be at risk from new AI applications. After crippling the stocks of software companies whose workflows AI could potentially automate or replicate internally, investors now see risks in sectors like real estate, transportation and logistics, as well as finance. New tools from Anthropic are threatening publishing companies, while Altruist has a tax-strategy tool that could undermine some financial services. This adds a new dimension to the ongoing correction in growth stocks, which the bears assert poses a threat to the sustainability of the bull market.

As I stated last week, I wholeheartedly disagree. There will be winners and losers from the rollout of AI just as there were in the late 1990s with the introduction of the internet to the masses. In recent weeks, investors have been myopically focused on the losers, which also triggered an unwind of excessive speculation in precious metals and cryptocurrencies. Yet few are focusing on the winners from AI, which are the countless companies in sectors other than technology that stand to benefit through increased productivity, improving margins, and accelerating earnings growth. This is born out in year-to-date performances with the Magnificent Seven down 7.3%, while the Russell 2000 small-cap index has surged 6.8%. We have a stock pickers market.

Encouraging Economic Data

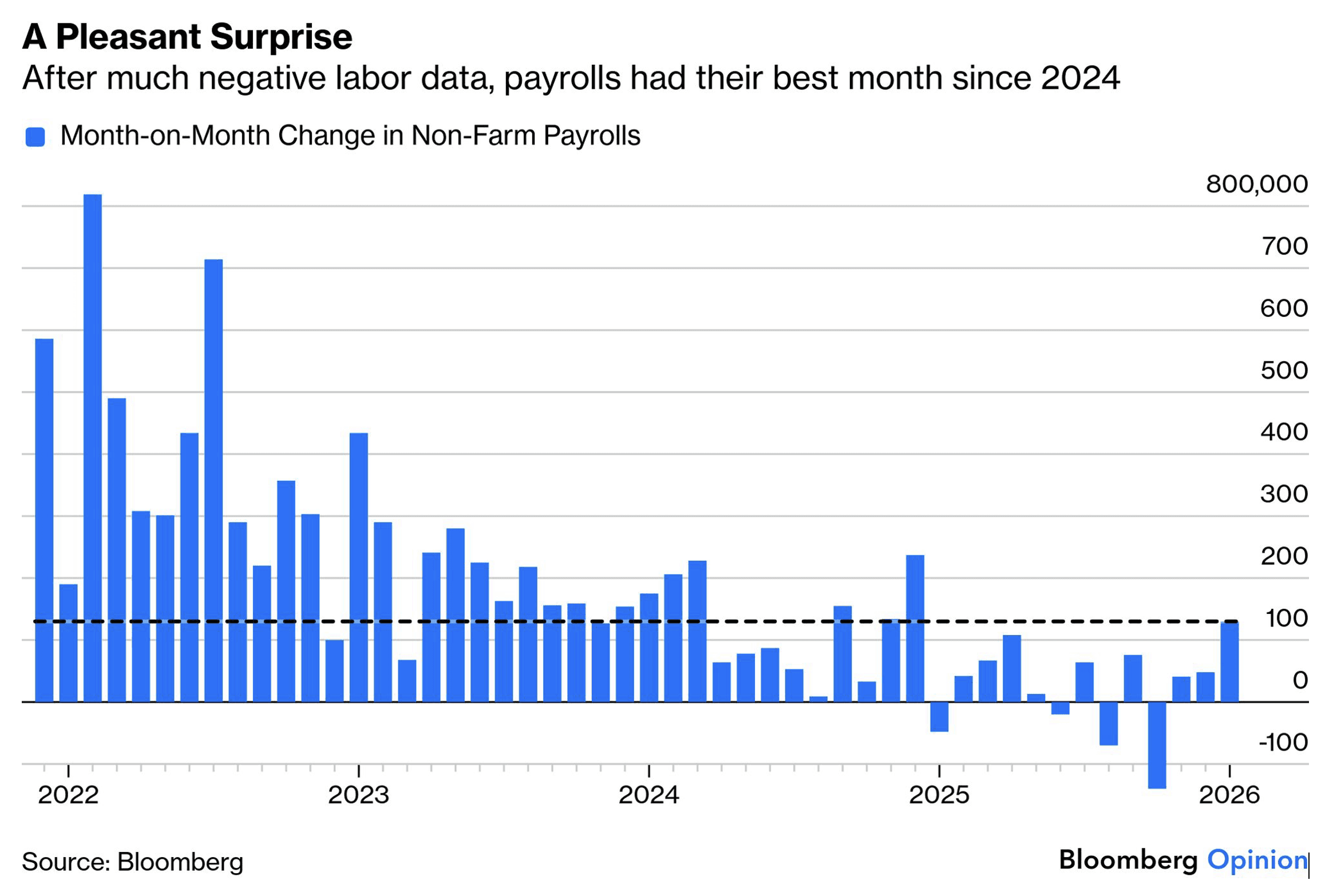

While last week’s economic reports were mixed, the balance still points to a positive overall rate of change. Retails sales were disappointing in December, and existing home sales plunged 8% in January, but payroll and inflation data were encouraging and weigh more heavily moving forward. The economy created a better-than-expected 130,000 jobs last month, which was the largest tally in a year, while the unemployment rate fell from 4.4% to 4.3%. Wages grew 0.4% from the month before, leading to a 3.7% annualized rate that results in a healthy level of real (inflation-adjusted) income growth. Real income growth is the life blood of real consumer spending growth, which is the primary fuel for our overall economy.

The inflation report for January was also better than expected with the Consumer Price Index (CPI) increasing 0.2% for the month and 2.4% over the past year to record its lowest rate since last May. The core rate, which excludes food and energy, rose 0.3% last month and an annualized 2.5%, which is its lowest level since March 2021. It appears that disinflation is back on track. This resulted in a drop in both short- and long-term interest rates, as investors moved up expectations for the next rate cut from the Fed to June. If job growth can sustain at approximately 50k per month and disinflation continues, I think we will see three more quarter-point rate cuts during the second half of this year. Given that earnings growth is broadening and accelerating, we have a Goldilocks economic environment for diversified investment portfolios to outperform in 2026.

Precious Metals And Cryptocurrencies Finding A Bottom

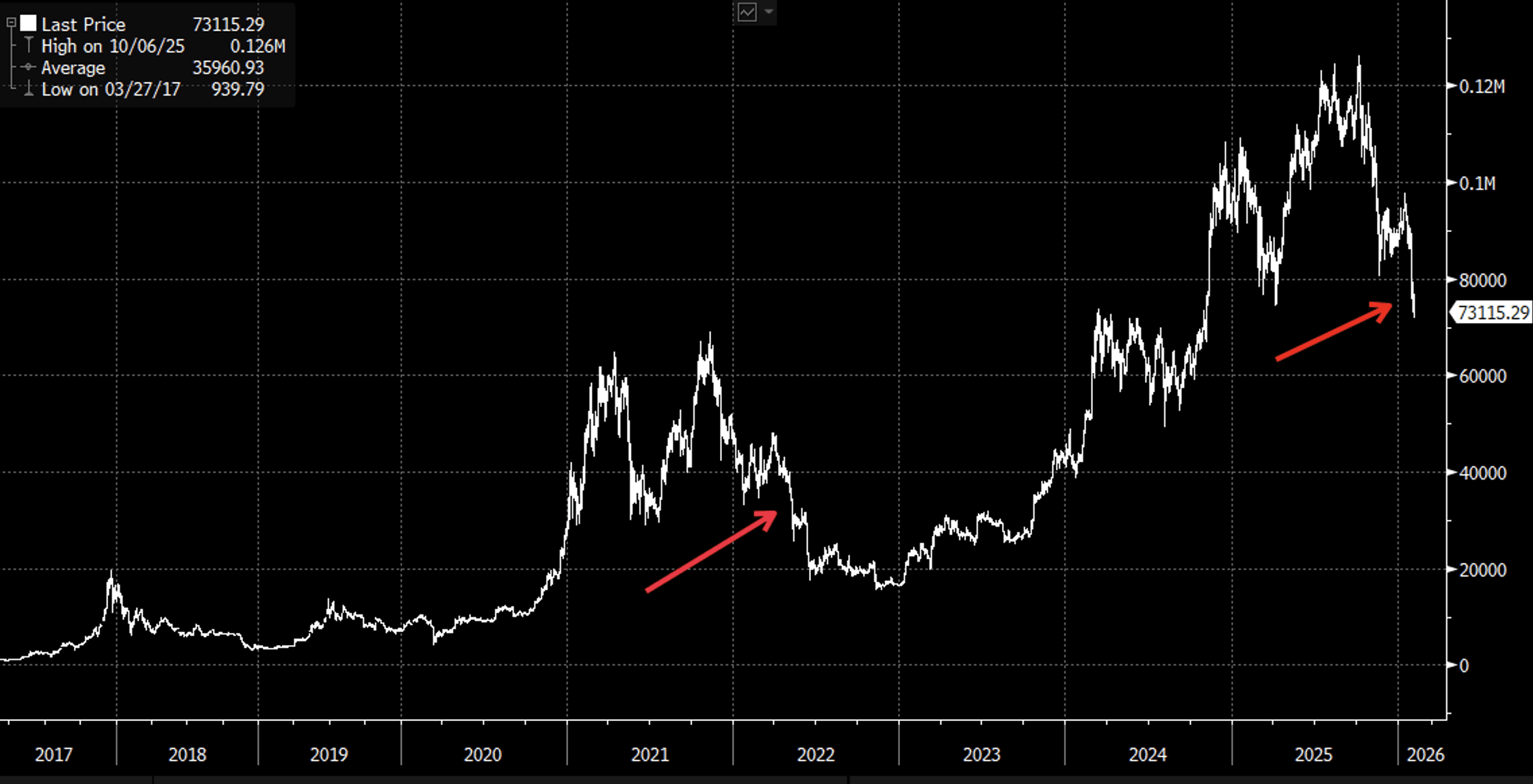

It is difficult to determine whether expensive growth stocks, cryptocurrencies, or precious metals instigated the selling in all three, but it is clear that the same cohort of speculative investors own them all, which is why a sharp decline in one fuel selling in the other two, as deleveraging ensues. So, where is the bottom? This is much easier to determine with individual stocks on a case-by-case basis, because we can use fundamental analysis. It is far more difficult with the other two.

Bitcoin was assumed to be a hedge for a weakening dollar and rising geopolitical uncertainty, further bolstered by declining short-term interest rates and inflation expectations. Instead, it seems to have morphed into more of a speculative trading vehicle driven by liquidity and the same risk-appetite we see for meme stocks. From that standpoint, it is now facing competition from event betting on predictions markets like Polymarket. While the token is now owned by some 200 public companies, as an asset held by corporate treasuries, it must be marked to market each quarter as a gain or loss in financial reports. As it declines in price, risk managers are inclined to sell, which puts more downward pressure on its price.

I think we are likely to find a bottom in concert with the trough in price for precious metals and technology stocks. If history repeats on the technical front, that may coincide with a level of $50,000 to $55,000. After the recent break below last April’s low of $74,000, that range would be consistent with the percentage decline we saw in 2021-2022. The head-and-shoulders patterns are nearly identical, which is why I think that level is where we most likely see demand start to outstrip supply.

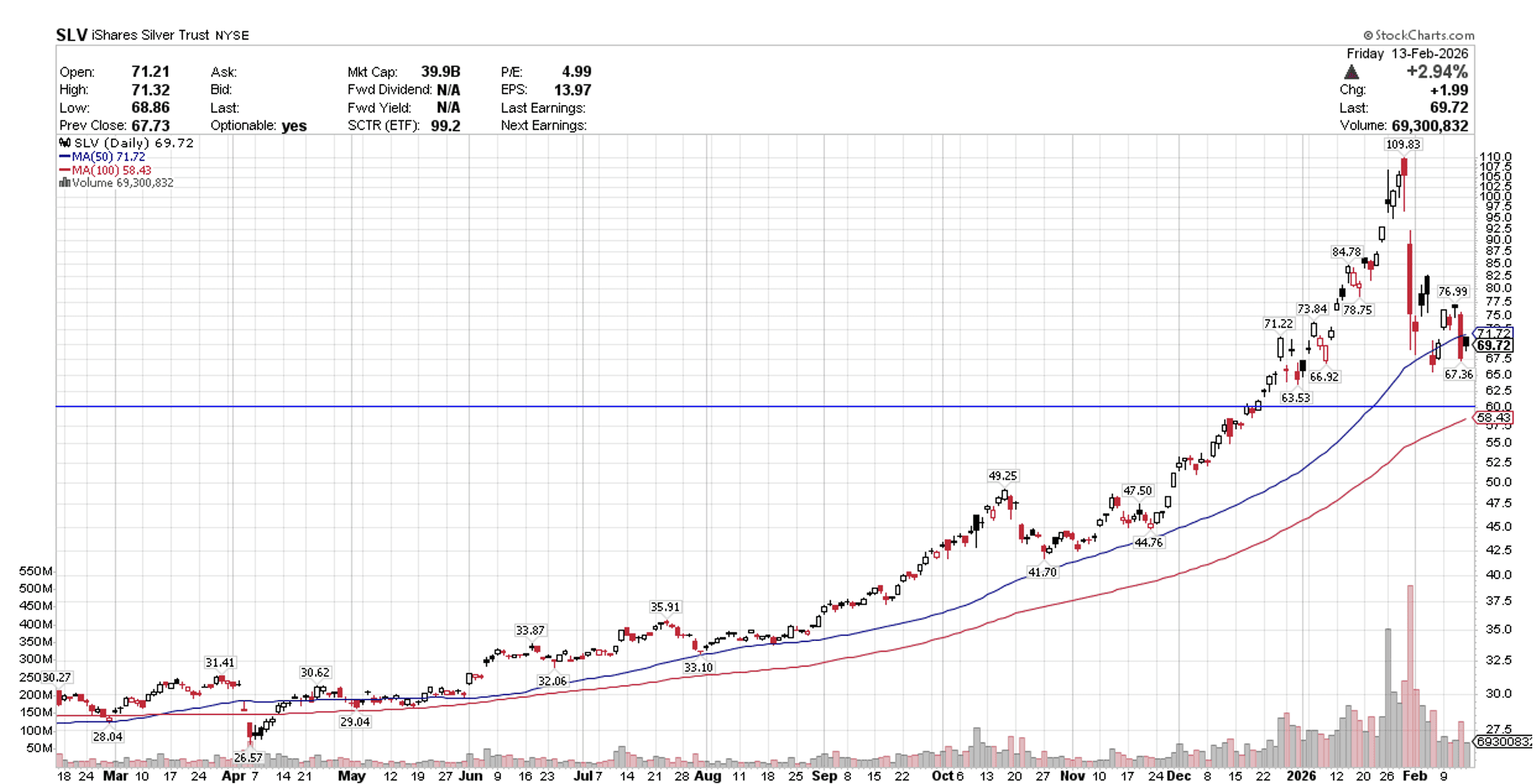

I have a lot more confidence in gold and silver reasserting themselves as effective hedges to currency debasement and geopolitical risks. Gold purchases reached a record high last year, as foreign central banks continue to sell US Treasuries in lieu of gold, which should provide sustained demand. According to Goldman Sachs, both metals account for just 0.17% of American investors combined wealth in stocks and bonds, meaning they are still under owned. Silver demand has been outstripping supply for more than five years, due to industrial demand from AI data centers, solar equipment, and electric vehicles. I think both are more reliable non-correlated assets in diversified investment portfolios.

Should the selling in cryptocurrencies and expensive growth stocks continue, I think silver has a more durable support level at its 100-day moving average, which is approximately $60 per ounce. This is a level that should provide better risk versus reward for long term investors looking to increase exposure.

Lawrence Fuller

Founder of Fuller Asset Management & dub Portfolio Creator SeekingAlpha Top Contributor (22k followers)

Background

With three decades of experience in portfolio management, Lawrence commenced his career at Merrill Lynch in 1993 and subsequently held similar roles at various Wall Street firms before establishing Fuller Asset Management in 2005. Since 2013, he has been an esteemed contributing writer for Seeking Akpha, authoring the widely followed Morning Brief newsletter, which boasts a dedicated readership exceeding 22,000 investors.

© 2026 DASTA Incorporated. All Rights Reserved. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. The dub app is owned and operated by DASTA Inc.. Advisory services provided by Dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. This content is provided for informational purposes only and is not intended as and may not be relied on in any manner as a recommendation or endorsement of any user, portfolio, thematic idea, or ESG factor offered by DASTA Incorporated (DBA “dub”) or its subsidiaries or affiliates (together “dub”). All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results, and investors should consider their own investment goals, risk tolerance, and financial situation before investing. The content herein is not warranted as to completeness or accuracy and is subject to change. The information presented, and its importance is an opinion only and should not be relied upon as the only important information available. The information may contain forward looking statements, including assumptions, estimates, projections, opinions, models and hypothetical performance analysis, which are inherently subjective. Changes thereto and/or consideration of different or additional factors could have a material impact on the statements made herein and Dub assumes no liability for the information provided. Advisory services provided by DASTA Investment, LLC (“Dub Advisors”), an SEC-registered investment adviser. Brokerage services provide by Dub Financial, LLC, and clearing and execution services by APEX Clearing Corporation (“Apex”), both SEC-registered broker-dealers and members of FINRA/SIPC. The registrations and memberships above in no way imply that the SEC, FINRA, or SIPC has endorsed the entities, products or services discussed herein. Additional Information is available upon request.