Fundamentals Override Geopolitical Concerns

Jan 26, 2026

•

Lawrence Fuller

The Economic Expansion Continues

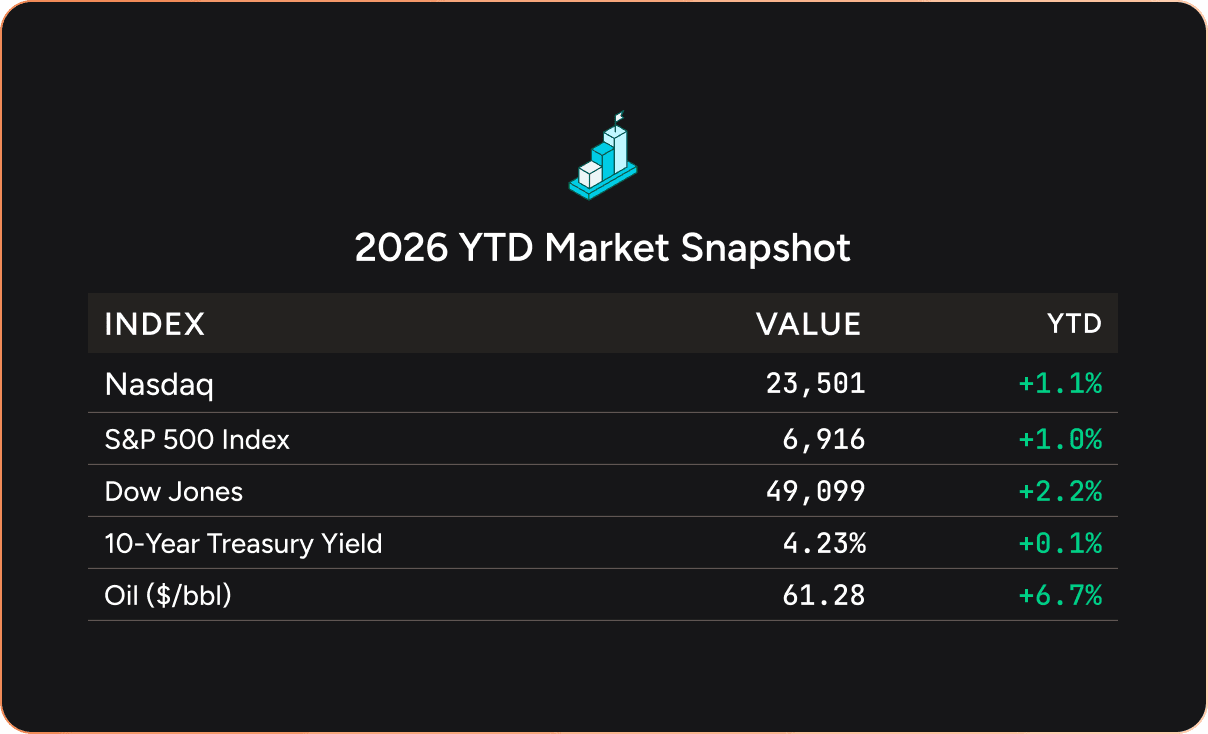

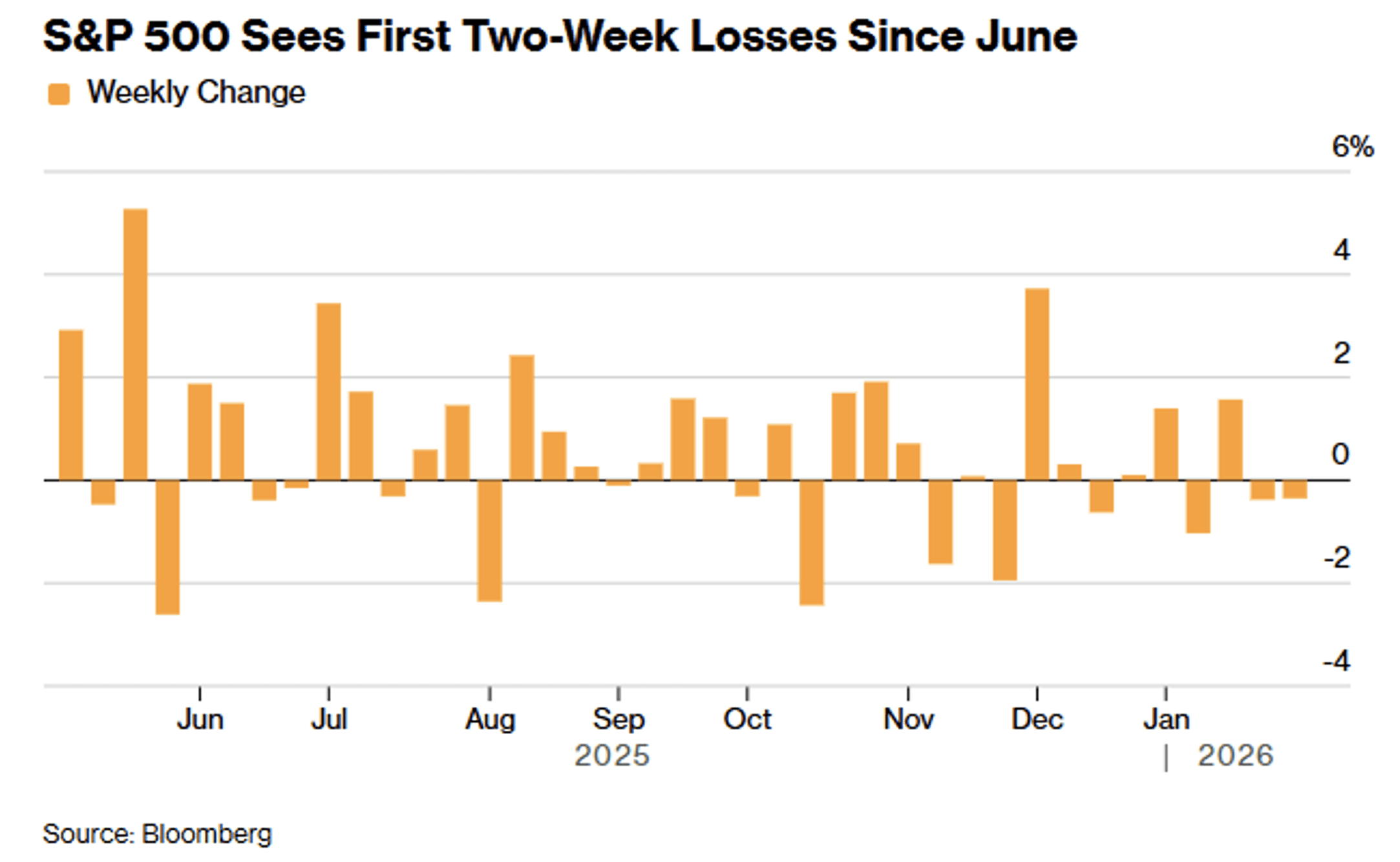

Let us hope that geopolitical uncertainty hit its peak last week in Davos at the World Economic Forum. The threat of tariffs on eight EU nations for not acquiescing to President Trump’s ambitions to acquire Greenland sent stock and bond prices reeling on Tuesday. Then news broke that the threat had been rolled back, leading to a rebound that left the major market indexes modestly lower by week’s end. Still, the S&P 500 has now posted its first back-to-back weekly loss since last June. The primary benefactor of the elevated uncertainty continues to be precious metals, as the price of gold approached $5,000 an ounce, while silver surpassed $100 per ounce. Geopolitical events such as these rarely undermine the uptrend in a bull market, which is far more dependent on corporate revenues, profits, and economic growth. All three points to more upside.

Behind last week’s drama we learned that the high-frequency economic data in aggregate signal that the economic expansion remains on track. Initial unemployment claims were a mere 200,000 last week, indicating a stable labor market that exhibits just as little firing as new hires. The University of Michigan’s consumer sentiment survey rose 3.5 points in January with modest improvement seen across all demographics. Personal spending in November, albeit backward looking, rose 2.6% on an inflation-adjusted basis over the prior year, suggesting a steady pace of growth for the economy’s primary engine. On a timelier basis, last week’s Redbook Same-Store Sales Index showed spending at some 9,000 general merchandise stores increased 5.5% over the prior year, which shows the consumer remains resilient, despite depressed levels of sentiment.

Staying Small And Thinking Global

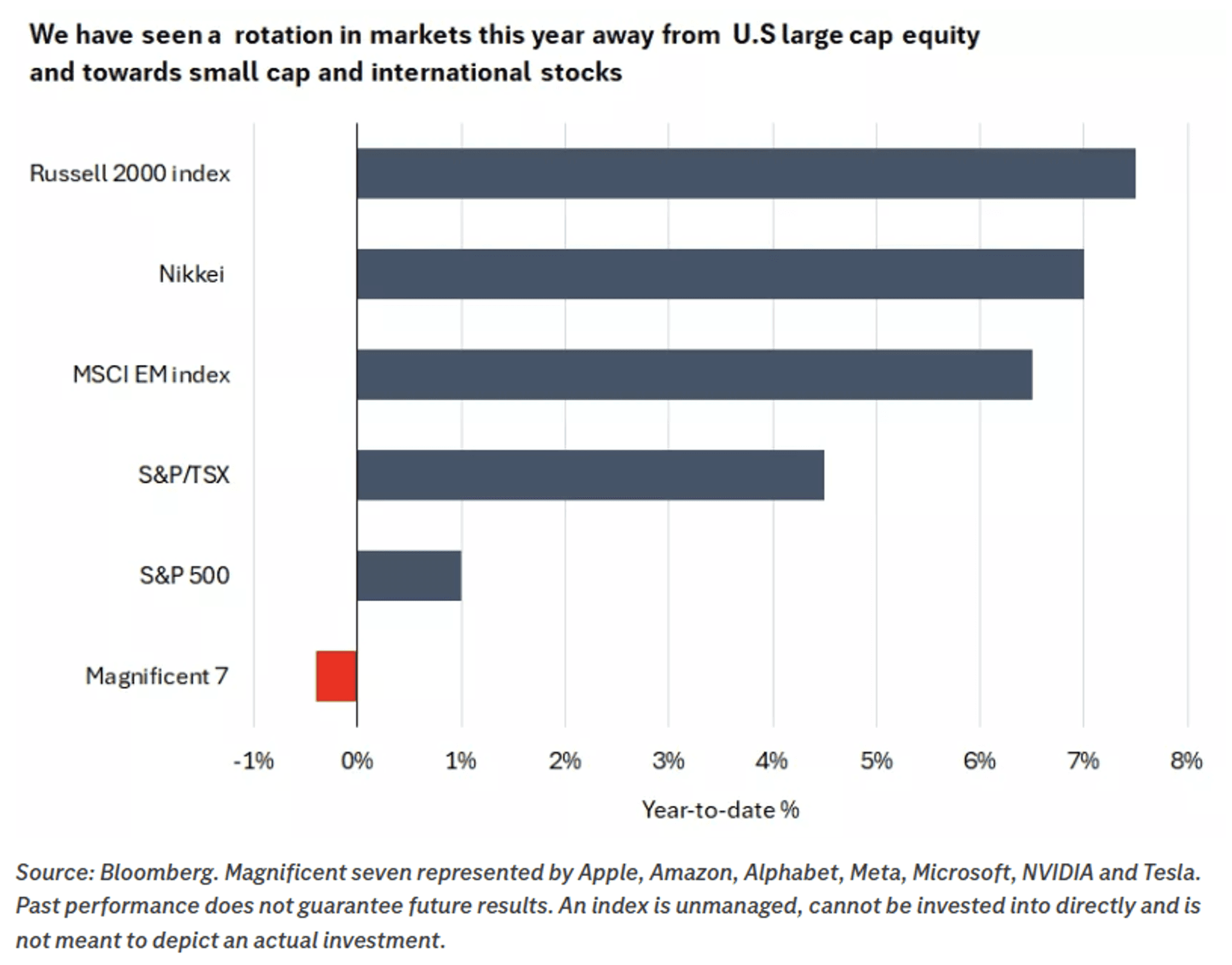

In a role reversal, the Russell 2000 index led stocks lower on Friday with a steep decline of 1.8%, but that looks like nothing more than profit taking after a record 14 consecutive days of outperformance over the S&P 500. This year’s leadership from small-cap stocks, and the rotation from the technology sector into other sectors of the market speaks to the need for investors to diversify beyond what has led the stock market to multiple new all-time highs over the past two years.

Furthermore, beyond our borders international markets are outperforming the US for a second year in a row, as fund flows for 2026 into Europe and Japan have far exceeded those into our stock market. Again, I think diversification not only among domestic market caps but also across the globe will be a key to outperformance this year. It also may reduce the degree of drawdowns when the next correction comes.

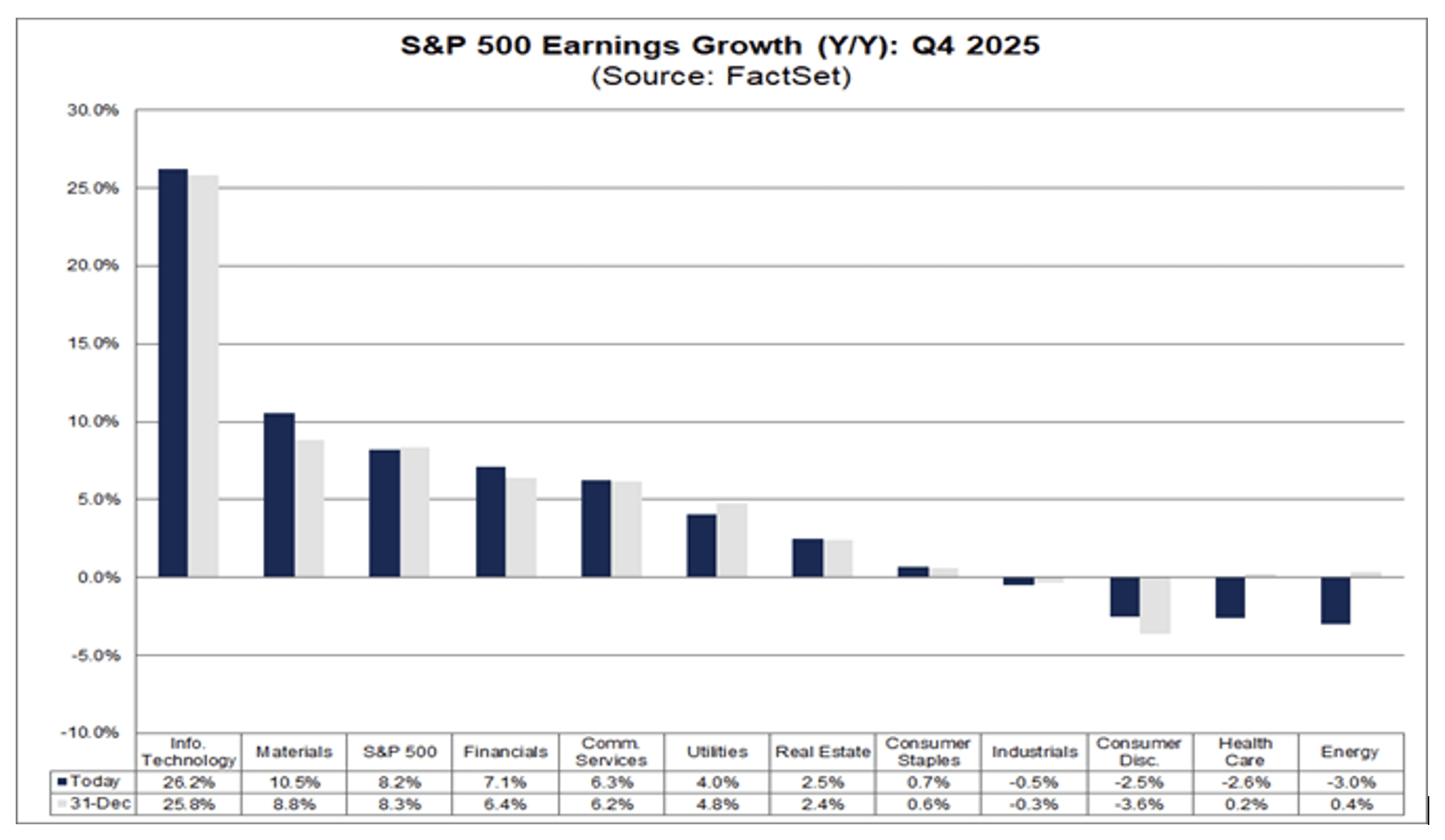

The Earnings Season Picks Up Steam

Hopefully, the focus will shift from geopolitical strife to corporate earnings this week with approximately 100 members of the S&P 500 reporting, led by four of the Magnificent Seven, which include Tesla, Microsoft, Meta Platforms, and Apple. With 13% of S&P 500 constituents having reported results so far, 75% have outperformed estimates, but the degree of outperformance is slightly below the five- and 10-year averages. Still, the year-over-year growth rate held close to its end of quarter expectation at 8.3%.

The forward 12-month price multiple for expected earnings is a lofty 22.1 times, but the net profit margin of 12.8% that is expected for the fourth quarter is also near historical highs. Higher profit margins warrant higher valuations for stocks, and margins should continue to expand as more companies implement AI efficiencies into their business models. Currently, only 18% of companies report using this new technology to better their output per worker. As this percentage grows so should profit margins.

Additionally, it is important to note that the elevated price-to-earnings multiple for the broad market is predominantly due to valuations in the technology sector. There are far more reasonable valuations in other sectors where numerous stocks are realizing impressive earnings growth with lower multiples. This speaks to the importance of diversification in 2026, as breadth continues to improve. Pullbacks and corrections should be buying opportunities, so long as the rate of change in high-frequency economic data continues in a positive direction.

Lawrence Fuller

Founder of Fuller Asset Management & dub Portfolio Creator SeekingAlpha Top Contributor (22k followers)

Background

With three decades of experience in portfolio management, Lawrence commenced his career at Merrill Lynch in 1993 and subsequently held similar roles at various Wall Street firms before establishing Fuller Asset Management in 2005. Since 2013, he has been an esteemed contributing writer for Seeking Akpha, authoring the widely followed Morning Brief newsletter, which boasts a dedicated readership exceeding 22,000 investors.

© 2026 DASTA Incorporated. All Rights Reserved. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. The dub app is owned and operated by DASTA Inc.. Advisory services provided by Dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. This content is provided for informational purposes only and is not intended as and may not be relied on in any manner as a recommendation or endorsement of any user, portfolio, thematic idea, or ESG factor offered by DASTA Incorporated (DBA “dub”) or its subsidiaries or affiliates (together “dub”). All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results, and investors should consider their own investment goals, risk tolerance, and financial situation before investing. The content herein is not warranted as to completeness or accuracy and is subject to change. The information presented, and its importance is an opinion only and should not be relied upon as the only important information available. The information may contain forward looking statements, including assumptions, estimates, projections, opinions, models and hypothetical performance analysis, which are inherently subjective. Changes thereto and/or consideration of different or additional factors could have a material impact on the statements made herein and Dub assumes no liability for the information provided. Advisory services provided by DASTA Investment, LLC (“Dub Advisors”), an SEC-registered investment adviser. Brokerage services provide by Dub Financial, LLC, and clearing and execution services by APEX Clearing Corporation (“Apex”), both SEC-registered broker-dealers and members of FINRA/SIPC. The registrations and memberships above in no way imply that the SEC, FINRA, or SIPC has endorsed the entities, products or services discussed herein. Additional Information is available upon request.