Buyers Beware Of Rotation, Valuation, And Speculation

Feb 2, 2026

•

Lawrence Fuller

January Bodes Well For The Rest Of 2026

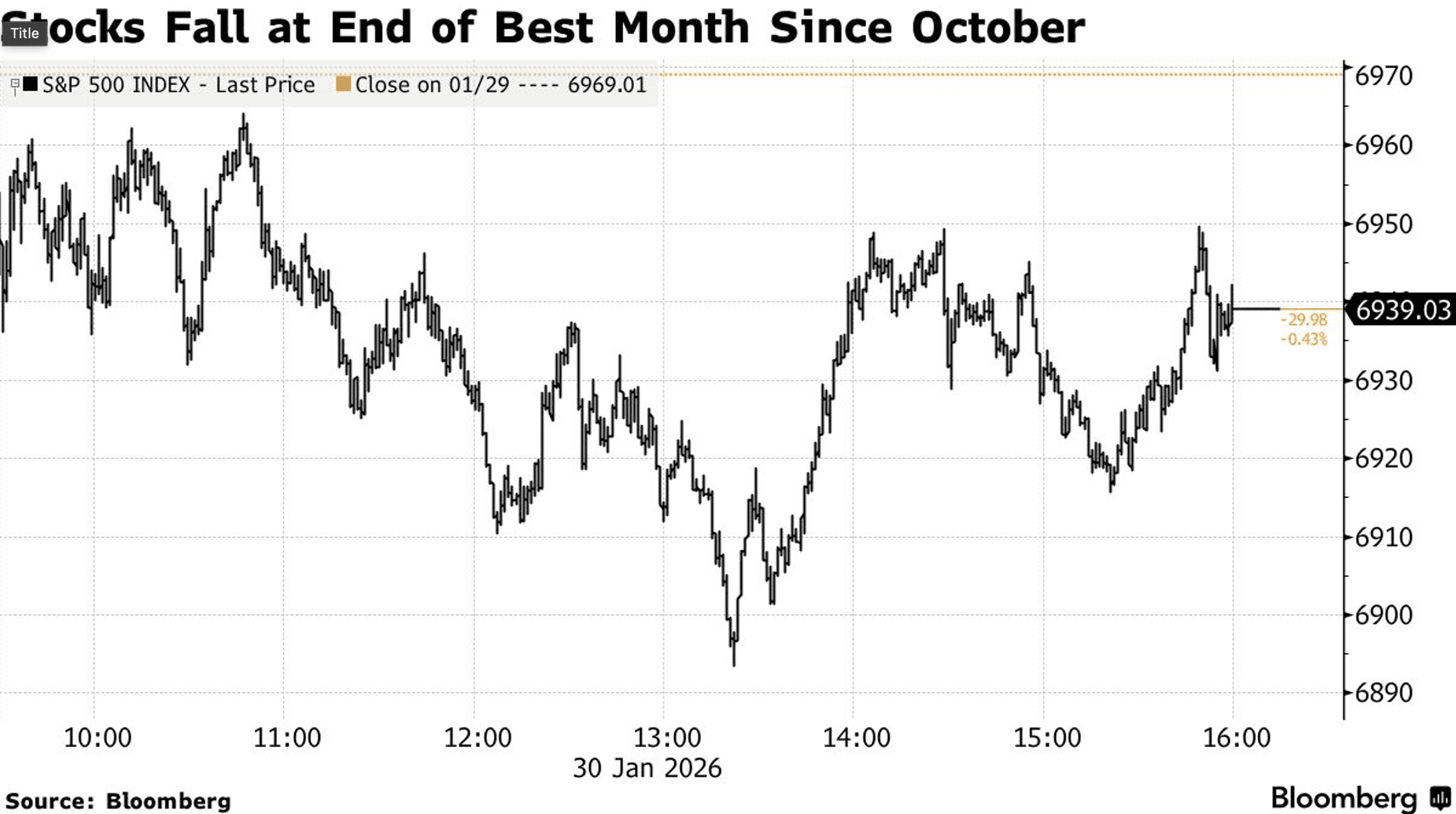

It was an extremely volatile week for markets, but the S&P 500 managed to eke out a small gain of 0.3%, which led to a 1.4% return for the month of January. Why is that relevant? When the index posts a positive return for the month of January, it has resulted in a positive return for the year 86% of the time with an average gain of 16%. When the index declines in January, the average annual return for the year falls to 2.3%, and it is positive just 61% of the time. January’s gain is an encouraging tailwind for the remainder of this year, but I will finish with an even stronger one, so please read on.

As expected, the Fed left its benchmark rate unchanged last week, as Chairman Powell gave a relatively upbeat outlook for the economy, emphasizing that the labor market had stabilized, while inflation still remains elevated. While services inflation has eased, goods inflation has picked up due to tariffs, but those price increases should start to roll off during the second half of this year. The more important news was in President Trump’s selection of former Fed Governor Kevin Warsh to be the new Fed Chairman. Some assume he will be more dovish than Chairman Powell, lowering short-term rates at a faster pace come May, but the spike in the dollar that weighed on markets Friday raises questions on that front.

Warsh was a hawk during his tenure on the Fed board from 2007-2011 and has been a sharp critic of bond purchases by the central bank, otherwise known as quantitative easing. That runs counter to the tune he clearly had to sing to be chosen. Regardless, he is qualified and brings experience, which markets should welcome. I still think we will have at least two more rate cuts during the second half of this year to address a soft labor market, as lower rates of inflation resume, which is in line with the market’s view. His appointment should not change that.

The Rotation From Growth To Value Continues

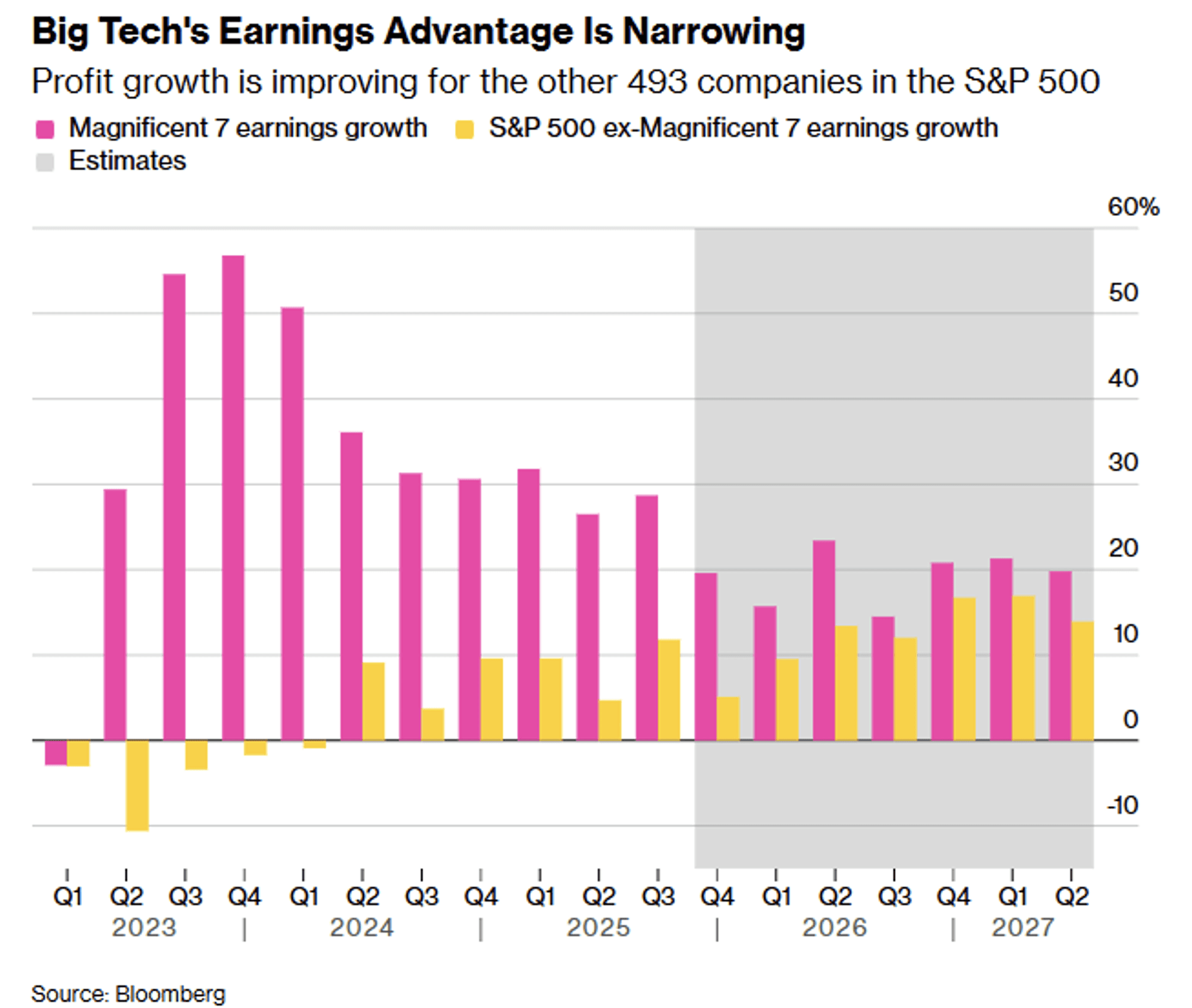

The next stage of the AI revolution is taking shape as more companies in nearly every sector start to implement the technology to realize productivity gains. This handover from the enablers to the users should result in margin improvements and profit growth, which is reflected in the earnings growth acceleration expected for S&P 500 constituents other than the Magnificent 7. I think this undermines the argument that we are in a stock market bubble. There may be companies and sub-sectors with bubble valuations, but there are countless names that are on the cusp of new earnings growth cycles This is fueling the rotation in terms of performance from growth to value and large cap to small.

Valuations are playing a more important role in returns this year, as the momentum names that led during the first three years of the bull market take a back seat to less expensive and more economically sensitive stocks. This is because earnings growth rates for the largest and highest growth companies, while still impressive on an absolute basis, have slowed substantially. Meanwhile, growth rates for the average stock, while lower on an absolute basis, are accelerating. Stocks respond to rates of change.

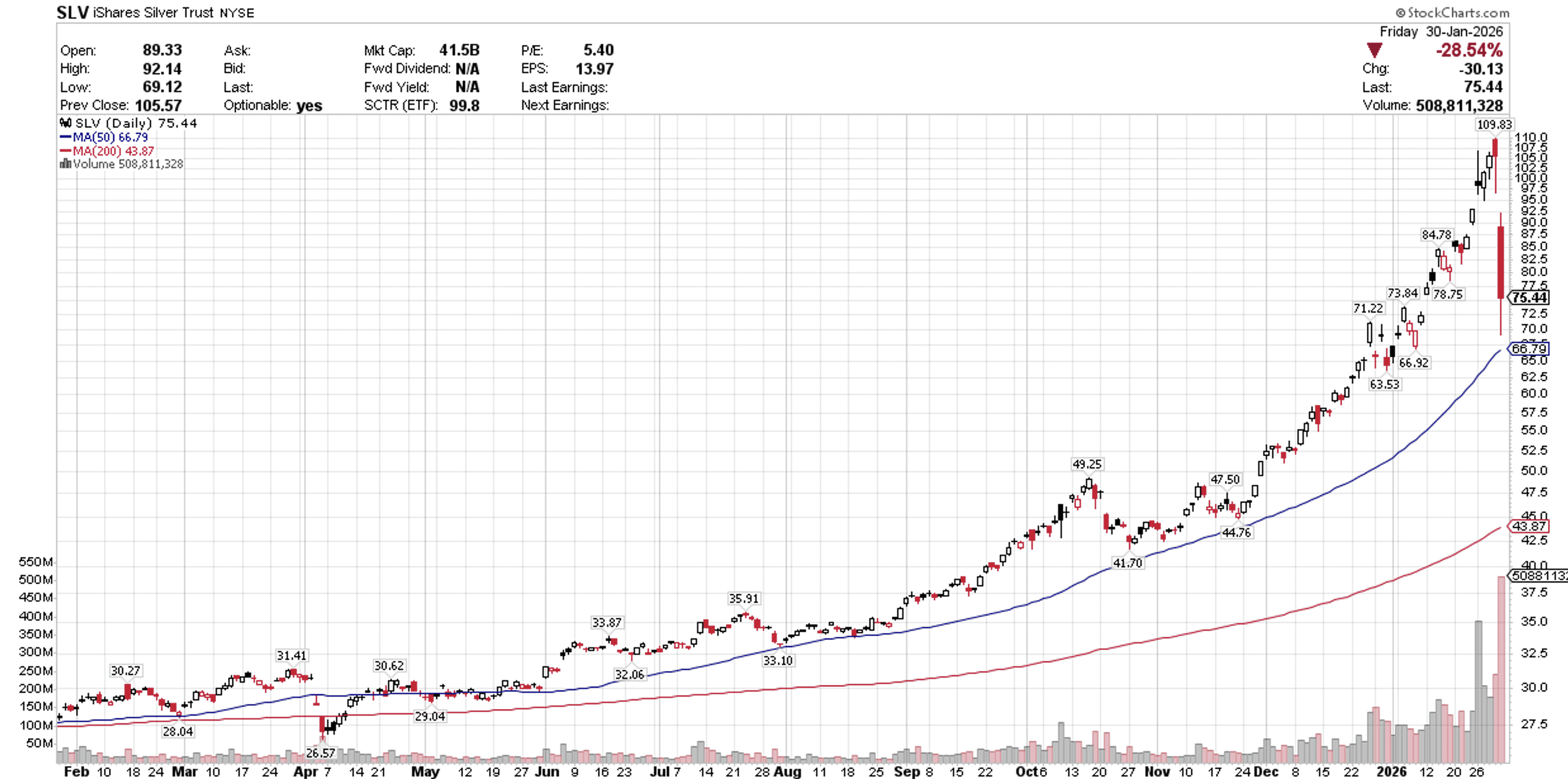

The Speculative Bubble In Precious Metals Pops

Two weeks ago, I discussed the dangers of chasing speculative momentum in precious metals, led by silver, sharing the chart below. The iShares Silver Trust (SLV) opened at $86.19 that Monday morning on its way to an all-time high of $105.57 last week. The more than 100% surge in price over the prior two months was rationalized with concerns about currency debasement, a weakening dollar, and increased industrial demand, but there was nothing rational about the move at all. I asserted that speculation by investors playing the momentum was the primary fuel for the parabolic move. As such, this game of musical chairs would not end well, as we ultimately learned on Friday when silver plunged some 30%. It was its largest single-day drop in history. Gold and silver have long been valuable components of a diversified investment strategy, because they were not correlated with risk assets, but when they started trading like meme stocks they no longer served that purpose and the writing was on the wall.

During Friday’s dose of reality, silver held support at its 50-day moving average, but I seriously doubt we will see the outsized returns of the past several months. In the near term, gold and silver will likely consolidate at best and find lower levels of support at worst before resuming their role as non-correlated assets that hedge against risk as opposed to fueling it. Once the speculation has cleared, real-world supply and demand dynamics should support higher prices over the longer term.

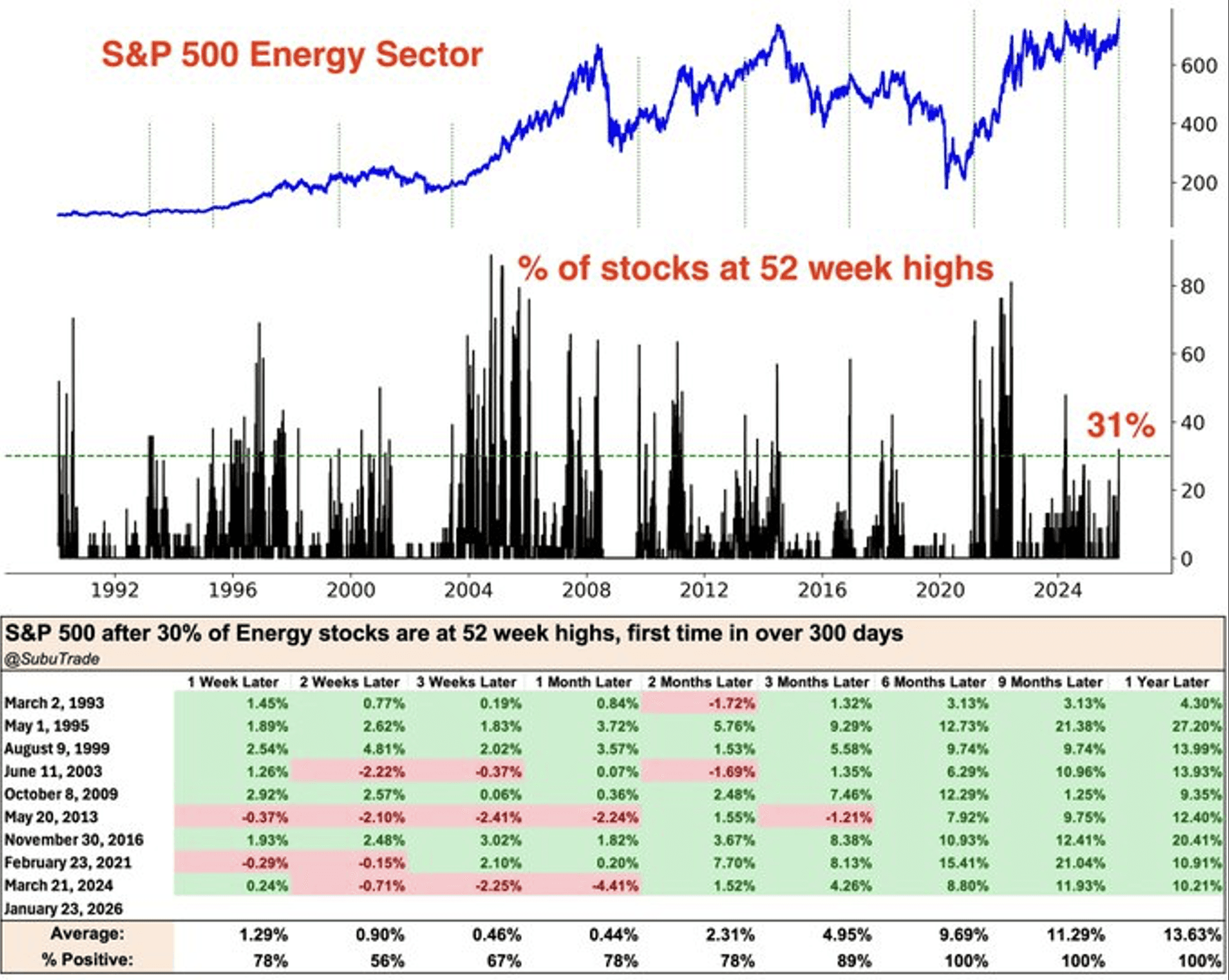

To finish on a positive note, energy has been the best performing sector this year, which sends a very bullish message for the market. The percentage of stocks in the energy sector that are at 52-week highs has risen above 31% for the first time in over 300 days. Why is that relevant? Historically, while the near-term results are mixed, the S&P 500 has been higher six, nine, and 12 months later every time this occurred. The reasoning for the rebound in the sector has varied over time, but the message has been the same. This is also consistent with the performance shift from growth to value and economically sensitive sectors and stocks. A positive return for January, more rate cuts ahead, broadening earnings growth, and energy sector outperformance all suggest that the bull market will continue.

Lawrence Fuller

Founder of Fuller Asset Management & dub Portfolio Creator SeekingAlpha Top Contributor (22k followers)

Background

With three decades of experience in portfolio management, Lawrence commenced his career at Merrill Lynch in 1993 and subsequently held similar roles at various Wall Street firms before establishing Fuller Asset Management in 2005. Since 2013, he has been an esteemed contributing writer for Seeking Akpha, authoring the widely followed Morning Brief newsletter, which boasts a dedicated readership exceeding 22,000 investors.

© 2026 DASTA Incorporated. All Rights Reserved. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. The dub app is owned and operated by DASTA Inc.. Advisory services provided by Dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. This content is provided for informational purposes only and is not intended as and may not be relied on in any manner as a recommendation or endorsement of any user, portfolio, thematic idea, or ESG factor offered by DASTA Incorporated (DBA “dub”) or its subsidiaries or affiliates (together “dub”). All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results, and investors should consider their own investment goals, risk tolerance, and financial situation before investing. The content herein is not warranted as to completeness or accuracy and is subject to change. The information presented, and its importance is an opinion only and should not be relied upon as the only important information available. The information may contain forward looking statements, including assumptions, estimates, projections, opinions, models and hypothetical performance analysis, which are inherently subjective. Changes thereto and/or consideration of different or additional factors could have a material impact on the statements made herein and Dub assumes no liability for the information provided. Advisory services provided by DASTA Investment, LLC (“Dub Advisors”), an SEC-registered investment adviser. Brokerage services provide by Dub Financial, LLC, and clearing and execution services by APEX Clearing Corporation (“Apex”), both SEC-registered broker-dealers and members of FINRA/SIPC. The registrations and memberships above in no way imply that the SEC, FINRA, or SIPC has endorsed the entities, products or services discussed herein. Additional Information is available upon request.